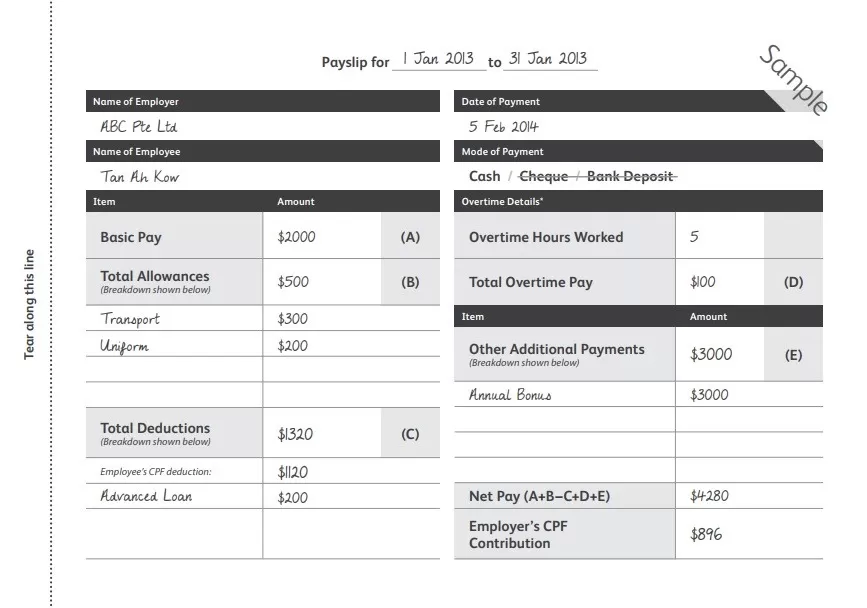

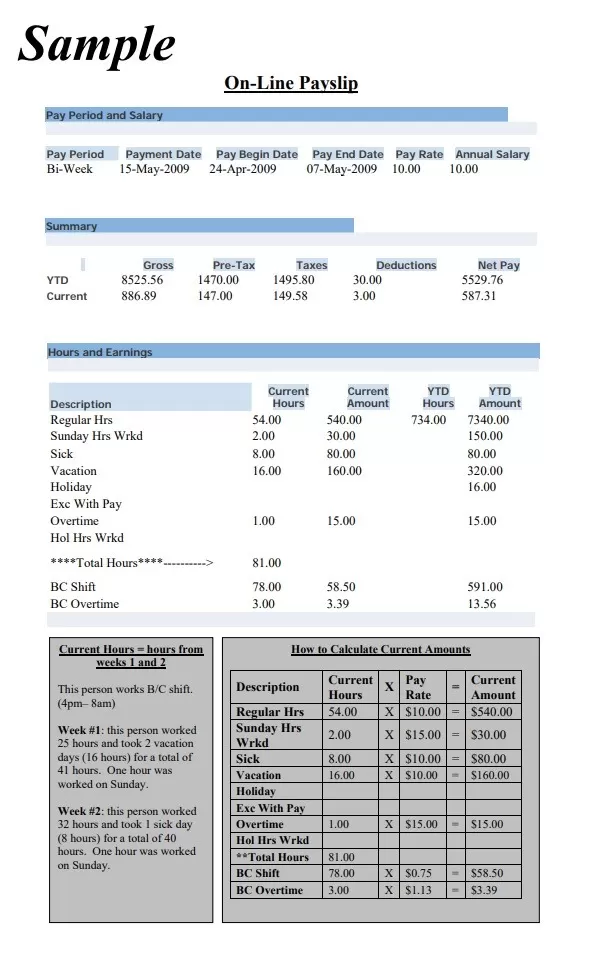

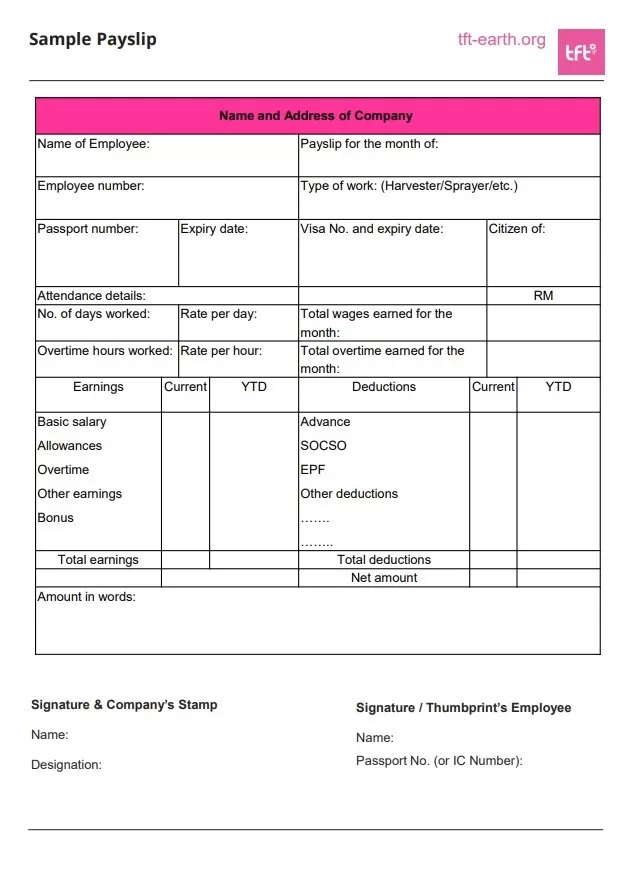

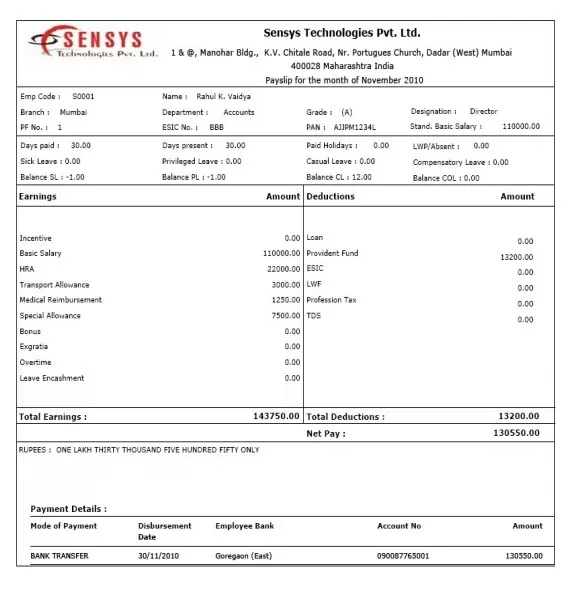

This template is an important document since it contains all the details for the tax, pension and insurance deductions as well. These templates can be made available to the employees in a number of different ways; they can be prepared manually or printed by some software. A payslip template, as the name indicates is an archive holding an official value, showing the exact amount of salary an employee is being paid along with the payroll number and all the deductions and tax withholding being made on the gross salary. It is basically the summary of the net amount of money being paid to an employee by the employer. Whatever the mode of preparation could be, the basic payslip format would always be the same.

Details of Payslip Template

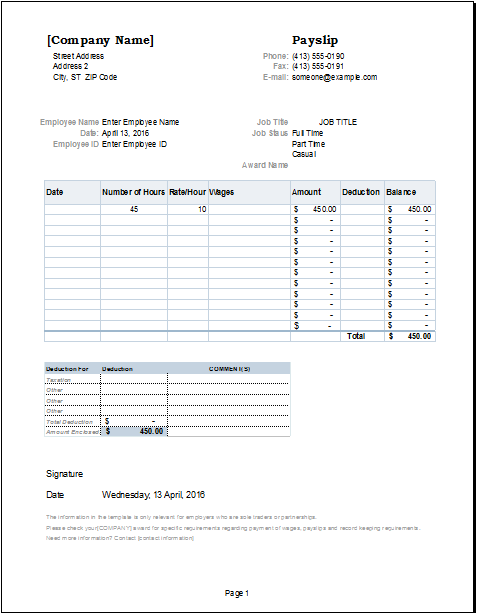

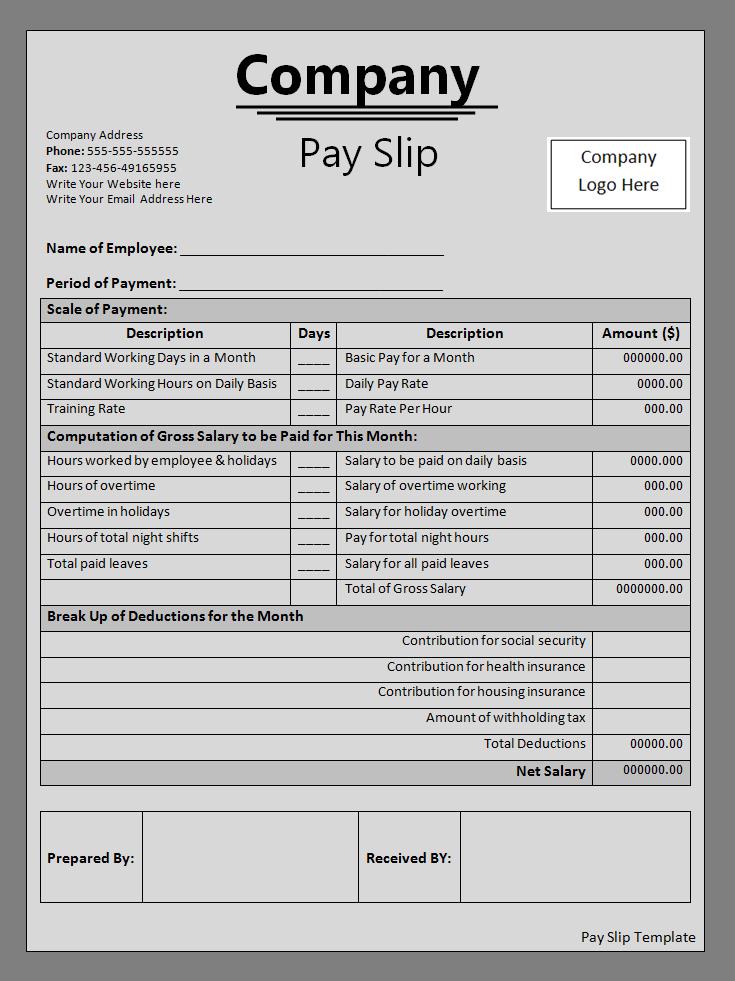

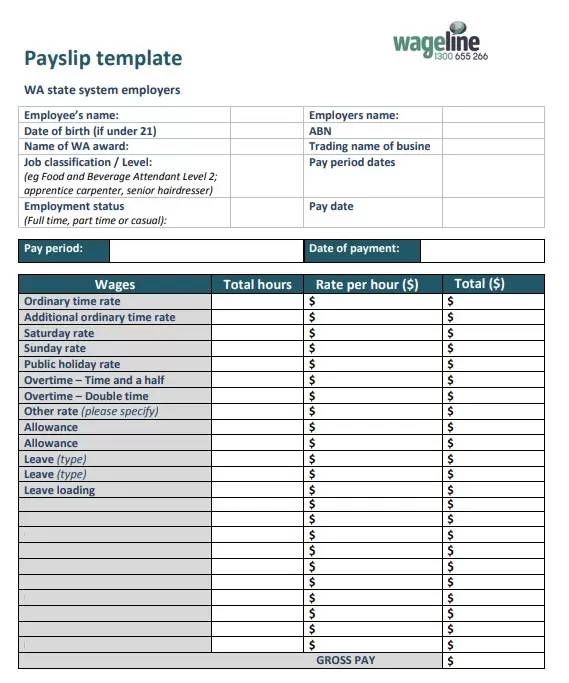

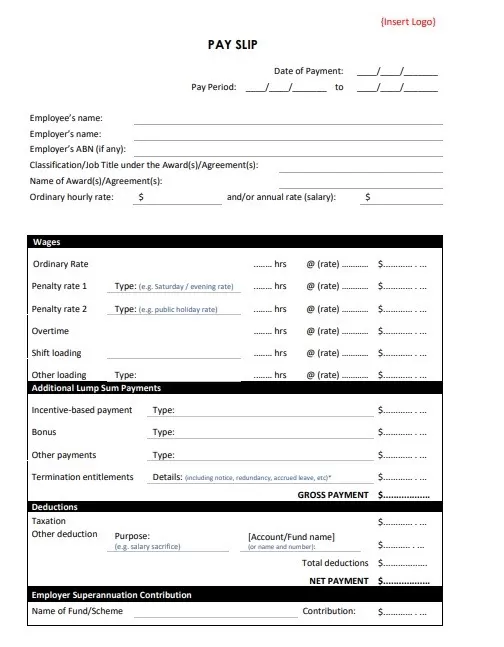

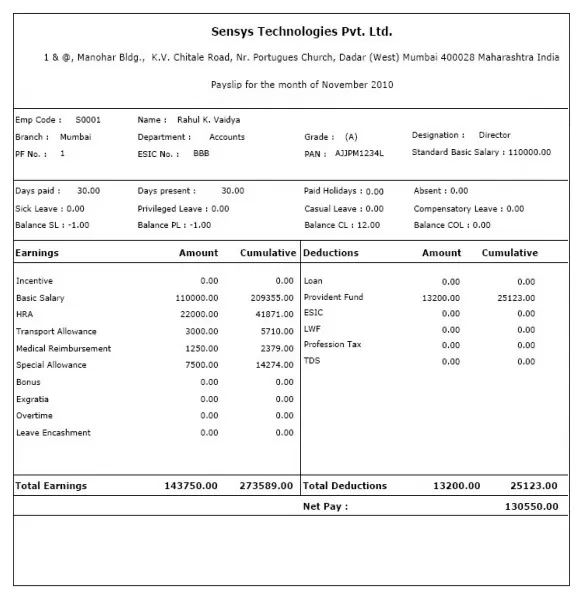

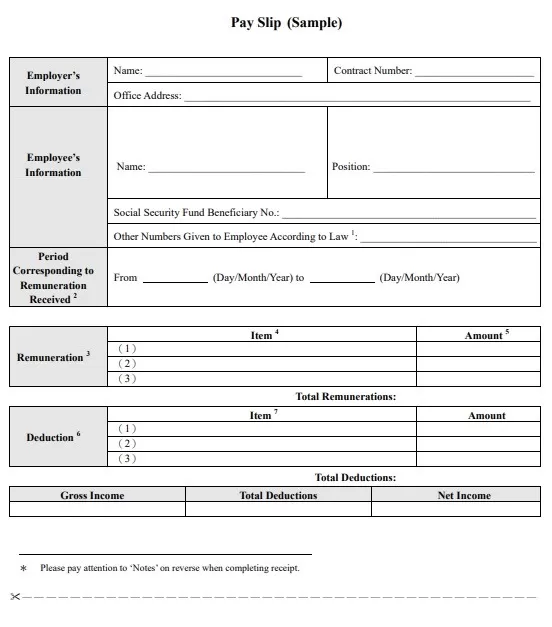

One of the significant roles of a payslip, is to give a much sorted out details of an employee’s monthly salary in simple configuration. This format incorporates the name and brief biodata of the employee, such as his/her designation at the company, net salary, working days, details for all the deductions, date, month, company name and signatures of the person in authority. An employee is supposed to go through all the details mentioned on his/her payslip in order to verify the authenticity of the information. It assists the company’s financial assistant to keep up a record of the pay rates for a particular employee. It is the legitimate right of an employee to get a professional salary format. Excel payslip templates are usually asked for by banks when a person applies for a loan. A download button provided underneath of properties segment along with template.

Content of a Payslip Format

To understand a payslip format fully, you will need to learn the content of it. A professional payslip template either in MS Word or MS Excel, must have following content within it. To give you better understanding, I am elaborating these points which you must understand. These are given below;

1- Name and Rank: A basic format of payslip required to have information about employee name and his/her job title.

2- Personal Information: A part from name and post title, other information must be included in this section. This information may vary from firms to firms however, it has details of tax number, employee ID, social ID and other information.

3- Date: It must have date of printing and issuing. The format of date will depend on organization’s policies.

4- Calculation of Salary: This is the most important segment of payslip. It includes the calculation of salary amount, basic gross salary, salary range, grade and perks.

5- Details of Salary: Further details of salary includes; bonus amount, if paid or earned. Daily allowances, monthly perks and increment.

6- Net deductions: Once salary amount is finalized then it comes deduction section. In this section, employee can see all deductions made by employer. This may include; tax amount, loan installment if availed and any advance salary if availed.

7- Details of PF and Pension: Monthly contribution of employee in term of provident fund and pension is part of this segment. An employee can check actual contribution made by him/her in total contribution. He/she may check total amount or balance in provident funds and pension. If organization allows borrowing from provident funds or pension then it should also mention in this section.

8- Record of Leave: This area shows the number of leave availed by employee. Other than that employee can also count the number of leave which he/she can avail in the future. It has different categories like; sick leave, urgent leave, medical leave and mandatory leave. This further vary from organization to organization based on HR policies.

9- Net Pay: After all inclusions and deductions, what left is called net pay. It is the amount of salary which shall deposit into your account. It is the amount which organization is willing to pay against salary account.

10- Other Information: A part from information other than mentioned above can be seen in this section. It includes; bank account number, amount of actual transfer into account and balances of all other perks. If further includes workplace benefits and perks as agreed by organization while hiring.

| Click the button given below to download this word file. File Size: 25 kb No. of Pages: 1  |

File Type |

Other Resources