A payslip can be described as a written note or small piece of document given to an employee by the employer as a record of pay. Yes! This slip may cover a certain amount of payment has been paid to the specific employee who work for a company. No doubt, this is a most common slip and it vastly used by almost every company where employees work against salaries. A payslip will work as an evidence of salary. So, the employer of company can also keep check on the history of salaries generated by company for each employee. This payslip will display some information which cover a certain amount of money has been deducted as insurance from the total earning of employee. However, an employer can also use a payslip when he/she all set to prepare a yearly report of salaries.

What is A Pay Slip and What are Advantages?

A payslip is an important document for both the company and employees. Actually, it is a document having legal approach. As a matter of case, it serve as a beneficial tool for employee as it helps them to make sure that a company is awarding them with actual amount of pays along with additional incentives. A payslip will use to show the employees they have a right tax code. Moreover, it also make sure each employee getting the right amount of pay after the deduction of several services charges along with taxes and fines. This slip will fully record that a certain amount of money has been earned by employee in total.

Payslip Formats and How It Works?

The format of payslip will help the employer to prepare slips for different employees working on different posts. It supports the slip maker to record each and every thing regarding the pay of employee in professional manner. Thus, it serves as an evidence of amounts has been paid by the company on specific dates. It may consist on several categories that a slip maker must have to fill before generating it, i.e. A professional slip provides detail information about the amount of pay, amount of taxes, insurance charges, utility cost, name of employee, title of company, address, mode of payment, gross payments, incentives, tax deduction, bonuses, over time payment, fines and other deductions as well.

Templates for Payslip Formats

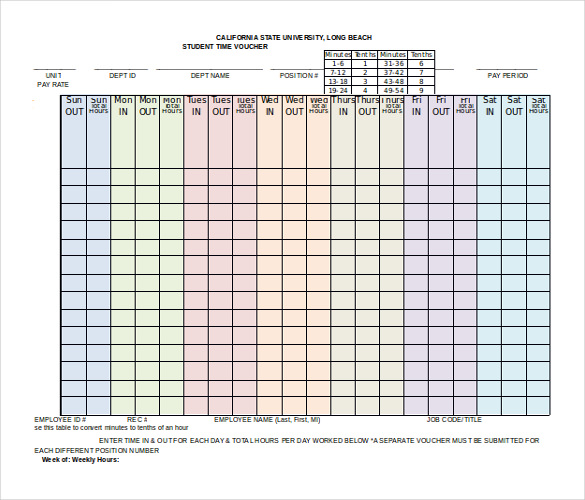

Click the button given below to download this word file.

File Size: 67 kb

No. of Pages: 1

daf.csulb.edu

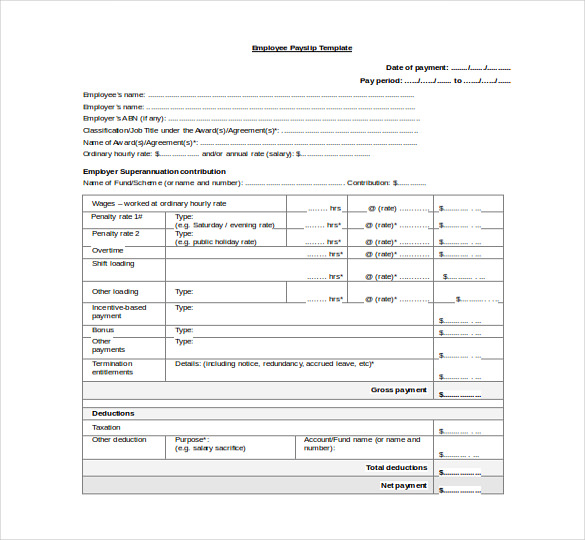

Click the button given below to download this word file.

File Size: 38 kb

No. of Pages: 1

taxpayer.com.au